As a sports enthusiast, particularly fond of football, I enjoy any analogies related to this discipline. Many great entrepreneurs often emphasize the importance of sports in business, value-building processes, character development, and so on. Today, I would like to share the experiences we have been actively gathering over the past few months as Data Octopus, working with clients from the medium and large e-commerce segment. I hope this post will prompt you to reflect and inspire you to look at your “team” and the strategy you choose to manage it in a new way. Let’s get started!

Advertising Account as a Game Arena

The playing field for football matches is the pitch. It is where the players move, each with specific tasks to accomplish. The outcome of the game and who wins depends on the successful execution of individual and team strategies (such as offensive or defensive formations). Similarly, an advertising account can be compared to a football pitch. The advertising account has its own areas, usually marked at the campaign level. Working on the entire account from a macro perspective yields results only when guided by a micro perspective (campaign, ad group, settings). As the saying goes, “You Can’t See the Forest Through the Trees” It is important to balance between the perspective of the entire account (macro) and that of a single product (micro).

Judging whether an advertising account is effective based solely on ROAS is a superficial approach. Unfortunately, many Store Owners or E-commerce Directors are satisfied with the principle that if ROAS is satisfactory, there’s no need to “look under the hood.” This is a flawed approach. Scenarios are quite possible where ROAS seems acceptable, but:

- An increasing number of SKUs are not selling at all, despite investments (our analyses show that this can be more than 50% of the entire offering).

- A large part of sales is unprofitable when considering margins (we have seen cases where only 1% of products sold were profitable after including the margin).

- Significant number of the SKUs, amounting to tens of percent, generate no costs or sales and remain completely dormant.

Campaign is a Position on The Field

If we have already covered the context of the advertising account as a playing field, we can now go a level deeper to the position on the account, also known as a campaign. A specific player is placed in a specific position by the coach for a reason. This is related to their skills, experience, and tasks on the field, which must align with the team’s overall goals. It turns out that key settings are often made at the campaign level. Should I optimize the product for maximizing conversion value or quantity? Should I set the tROAS to 5 or maybe 10? These are neither simple questions nor easy answers, especially considering that:

- There is a lot of data

- Data is constantly changing

- A lot of data are “vanity metrics,” which provide no real value

Creators of advertising systems like Google, Meta, and others are constantly optimizing their systems by integrating AI and automation more deeply. Anyone interested in AI knows how important the prompt and input data are. Everyone knows that “Garbage in → Garbage out.” Strategically, ensuring that the best possible data is provided to advertising systems is crucial. This allows you to leverage the full potential of AI, in which system creators invest millions of dollars, and prevents you from being limited to the role of an observer. We often hear from clients that they don’t like it when the algorithm goes for “low-hanging fruit,” increasing sales of a narrow range of SKUs because it’s easier for the algorithm to achieve the ROAS target there. This results in millions of dollars being tied up in unsold inventory, the need to constantly reorder a narrow segment of the offering, and difficulties in engaging new audience groups, among other issues. By adopting this approach, we gain greater control over the learning process.

Products are Your Players

We already know what the field and positions are. Now it’s time for the players. In football, there are a maximum of 11 players on the field. The entire team (including substitute players) often consists of around 20. It’s important to have a substitute who can change the course of the game, help achieve goals, and respond with positive changes when our stars on the field are having a bad day (it happens to everyone). The same goes for the products in your offering. You might have 500, 5000, 50,000, or even 500,000 products. Each of them is different (price, category, size, brand, etc.). Do you think it would be effective to assign a player to a position on the field based on hair color, eye color, shoes, etc.? I don’t think so. So why do most advertising account managers divide products into campaigns based on brand, category, etc.? Why aren’t products placed in campaigns they deserve, ones that are consistent with their role, experience, skills, and overall match strategy? I hope you are starting to understand our philosophy more and more. We believe, and we have an increasing number of case studies showing, that the approach we recommend is more effective.

There is still an important aspect of when, based on what data and situations, to move a product between campaigns. This is a good question, and the best answer, in true SEO fashion, is: “it depends.” It depends on whether we want to attack a new market and are very keen on selling as much as possible, with the margin taking a back seat. It depends on whether our goal is to quickly sell off the overstock while maintaining the highest possible margin. The answer to this question is not as complicated as it might seem. The answer changes over time and depends, among other things, on the season of the year. What we want to inspire and invite you to do is to ask yourself such questions, plan how to achieve your goals, and establish rules, principles, and a set of data that will facilitate this product flow.

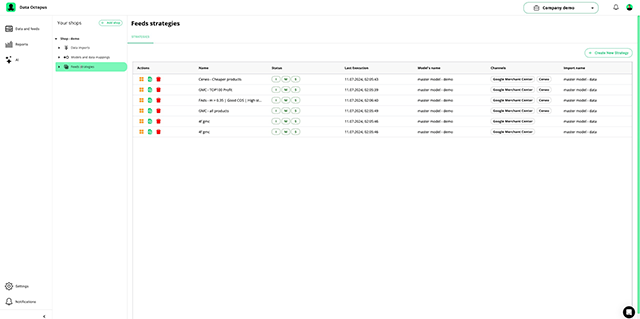

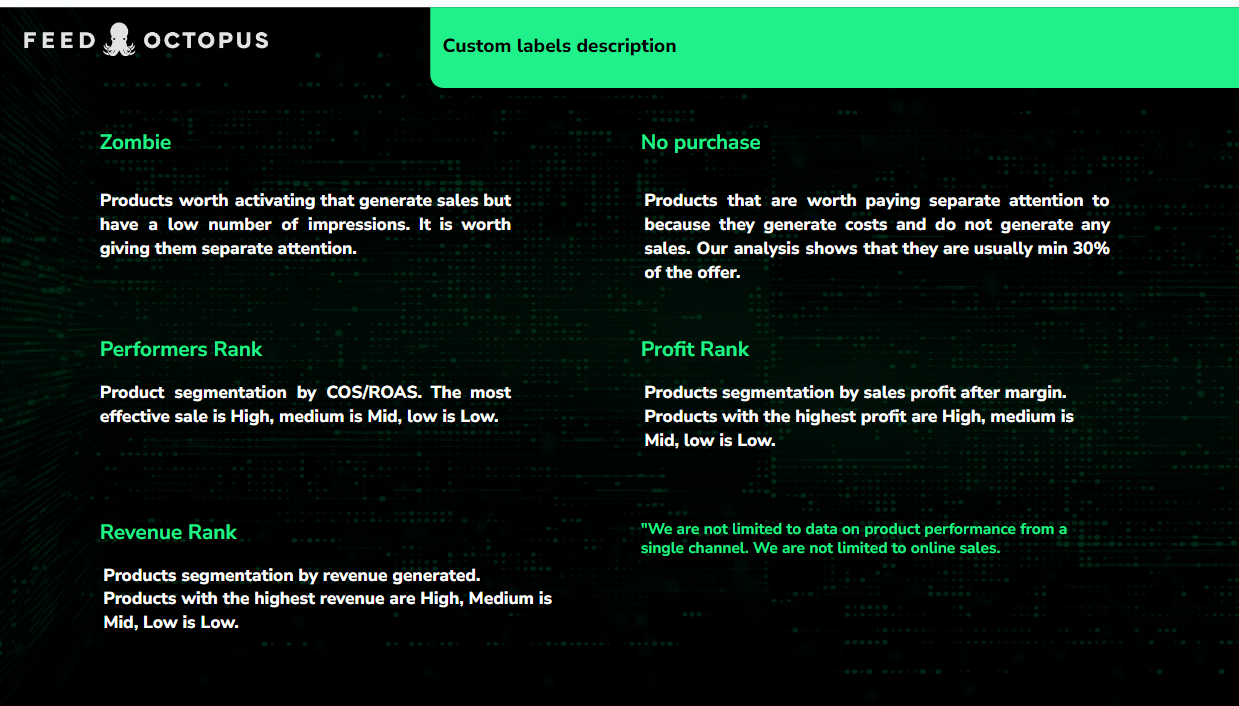

The graphic below is an example of how product segmentation might look. Which data and from what sources will be considered to make this segmentation depends. As Data Octopus, we have developed both schemes and methods for data collection at the individual product level. This allows us to collect information about it almost in real-time and effectively label it.

The Opposing Team is Your Competition

What would we do without competition? It drives us, puts pressure on us, and often motivates us to work hard. Healthy competition is very good and necessary. It’s important to be aware that many advertising systems still operate on an auction basis, despite becoming increasingly complex (from the user’s perspective, simplifying). In practice, we are competing not with one company that wants to reach the user with its advertising message but with many. Remember that business is a marathon, not a sprint, and as Professor Bartoszewski said: “Not everything that is worthwhile is profitable, and not everything that is profitable is worthwhile.” This means that while tactics can often be adjusted to the current situation, it is not worth frequently changing the overall strategy and its goals. Sometimes, one good month or quarter with spectacular sales growth may not pay off in the long run because margins have fallen, and we have not acquired new users, etc.

In our philosophy, we play continuous matches of lesser and greater importance. The playing field is the arena, and the players moving on it are your products in specific roles (campaigns, segments). On the other side is another team that can outplay you tactically even with a smaller budget.

At the end of this section, it is worth asking an open question: if the best coaches field their best lineup when playing against a tough opponent on their turf, why does an E-commerce Director invest in selling the entire range when entering a new market? Why not use the option of product selection based on feeds to start testing a new market while simultaneously limiting risk? This can be achieved by limiting the products in the feed to those that meet certain conditions, e.g., bestsellers in another market, those that open sales well, have the highest margin, or are from a foreign brand, etc.

Strategy as Your Plan to Win the Match

Okay, now that we have covered the basic concepts, let’s move on to strategy and tactics. As I mentioned earlier, product segmentation should not solely depend on the category from which the product originates, but also on how important its flow between campaigns is based on changing data at the source.

Our proprietary method is based on several steps, which can be divided into strategic and executional (implementation) areas.

We start by preparing the right data from the right sources. Our foundation is GA4 and Google Ads. However, it is not a problem to retrieve data from e-commerce engines such as Presta Shop or data from Google Sheets, Google BigQuery, XML, XLS, or URLs.

In the next step, the data collected into tables is cleaned and organized into a Master Model product data, which combines data from different systems based on ID. This way, we can build one large picture of products, containing much more data than a standard or even a moderately advanced product feed.

The next step is to launch Custom fields based on the data, which over time can transform into Custom labels and flow into the output feed for a given advertising channel. At this point, we support over 20 key channels for which we can generate feeds. It is at this stage that the first segmentation occurs, the results of which can be seen in the screenshots below. This segmentation forms the basis for discussing what the execution will look like.

Further steps involve working on the account, resulting in the launch of new campaigns, often excluding products from old campaigns, determining what the key metric of change is, and what change we expect. This is also the stage where we define how the flow of products between campaigns should look, how often Custom labels should be updated, etc.

Once we have information about which segment a given product belongs to, we can arrange the account structure to activate this information. It is very important for us not to stop at the information but to put it into action, thereby realistically impacting the value of the most important business metrics such as ROAS, sales level, and profit.

The whole process, in a very brief and simplified manner, is illustrated by the graphic below:

The topic of structure itself and the evaluation of the effectiveness of product sales to design it is quite extensive and a separate post has been devoted to it: ROAS is a King, but Profit is a Queen. In it I describe:

- What product data do we verify at the input?

- What can a modified account structure based on advanced Custom Labels look like?

- What conclusions can be drawn from the analysis of dozens of e-commerce?

Training as a Process of Improving Skills

Just as specific training enhances a football player’s skills, certain management practices on the account train the product in the eyes of the algorithms. If a product has achieved a ROAS of 5 in the last 90 days, will it be more effective to train it to achieve a ROAS of 7 first and then 10, or to aim for 10 immediately? Our tests show that a stepwise approach to guiding the product towards the upper right part of the campaign structure scheme is more effective. Players and products should be trained for the right skills that correspond to their role on the field and what they already excel at. A striker has different skills and goals compared to a defender. A product that is good at initiating sales will have different tasks than a product that finalizes sales.

Periodic Player Evaluations: Reviewing Your Product Offerings

Life, business, and digital marketing would be too simple if a one-time setup solved everything. Just as periodic lung capacity or blood tests are necessary for a football player, it is worthwhile to conduct a thorough review of strategy, results, product segments, etc., from time to time (we recommend once a month). Data Octopus helps with this by preparing specific views. Tactical changes can happen frequently depending on the opponent, goals, etc. However, strategic contexts should remain stable at least on a quarterly basis.

Flexibility of Positions on the Field: Team Play Instead of Individual Goals

I hope this material has intrigued and inspired you to look at your product offering differently and perhaps dare to manage it in a new way. Without stepping out of the comfort zone and having courage, there is no change, progress, or development. Many accounts have the potential for significant improvement in key metrics such as profit, revenue, or ROAS on both a micro and macro scale. An additional value is the time saved on data aggregation and analysis. I am very open to your feedback on our philosophy and comparing it with your experiences. Thank you for getting this far, and see you on the field!